A safe and permanent home is right at the top of the list of wishes most parents have for their family member with special needs. We give that to our family members when they live at home with us and we seek to keep that for them when they live independently. How are you planning to provide housing for your family member with special needs in the future? Many people I speak to plan to buy a home or condominium or leave the family house to the person with special needs. This newsletter reviews some of the considerations to think through as you take care of your planning.

My Blueprints planning process includes the Building Block where you set up a special needs trust. You will identify assets to fund the trust and other estate goals at this point – even though the trust will not be funded until later. The Special Needs Trust preserves eligibility for government programs like Supplemental Security Income (SSI) and certain Medicaid benefits.

A person with a qualifying disability loses eligibility if she has more than $2,000 in countable resources in her name. A house and a vehicle do not count as resources but they can still cause problems for eligibility and your family member.

One client came in to my office a few years ago. She was the trustee of her brother’s special needs trust and her brother’s guardian. The trust was funded with investment assets when her parent’s passed away. The family home was left to her brother with special needs – in his name. He continued to live in the family home and a local non-profit organization provided services in the home.

The sister was thrilled that this happened – at first.

He was comfortable at home. He knew how to navigate the local stores. He knew the bus route. His life looked very much the same even with the loss of his last parent.

It did not take too long for the scenario to change.

She came to see me when the situation stopped working well for her brother. The home required maintenance, as every home will. The home was eating into his trust resources above what it would have cost for him to live in an apartment. He was now alone too much of the time as he did not have family in the house. He did not have the same access to mobility.

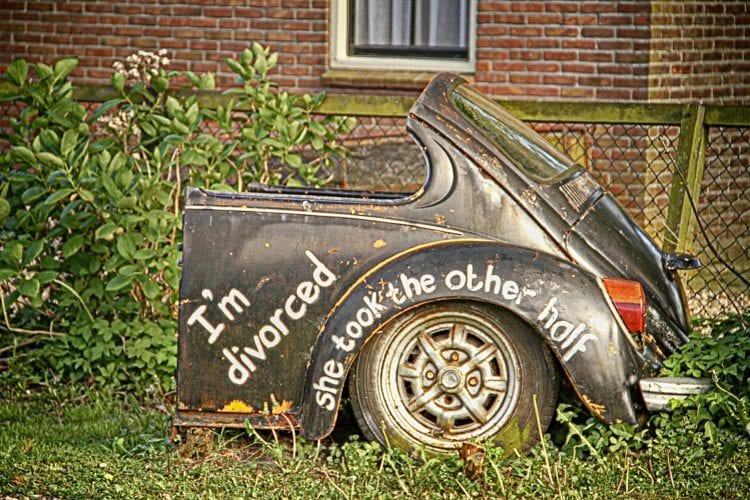

The home became a liability and it was time to sell the house.

The family now had a choice to make about what to do with the house. They could sell the house with the brother’s consent and participation. The net proceeds they would receive would be more than the $2,000 resource limit as the proceeds would be in his name alone. He would lose services and supports from the non-profit, lose access to health insurance and lose his monthly SSI check. He could reapply for all those benefits after spending the money from the house.

The other option for him was to have a first-party special needs trust put in place. He would take the house and transfer it to the trust after having one set up by an attorney and approved by Medicaid. At this point, Medicaid would have a lien on any assets left in the trust up to the amount spent on him by Medicaid over his life and anything left could go to the rest of the family. He would keep his SSI and Medicaid funding with this type of trust. The process ends up being costly and complicated when it did not ever have to happen.

The best option for most families is to make a different decision in advance of leaving an inheritance. This family could have set up a special needs trust funded by a third party – in this case either his Mom or Dad. The house could have been another asset of the trust – with any bank accounts, investment accounts and other real estate. The brother never would have had ownership of the house. The trust would have owned it the entire time. This way, the trust could have sold the house at a time when it no longer served its purpose for the family and the house would have been turned into another financial asset in the trust. There would have been no break in services and any remainder assets in the trust would have stayed with the family, instead of Medicaid.

While the house is not counted as a resource, it becomes a resource upon the sale. Passing the house to a trust takes away the headache of having to create a trust later and the pain of replacing government programs with personal assets until those assets are spent.

Planning for a family member with special needs is different than for typical families. Make sure you have a team who has experience with these issues.

Call to schedule an appointment to review your planning decisions or to discuss future planning needs.